Concerns around mortgage affordability reduce and housing market sentiment shows signs of recovery, Property Tracker reveals

The latest Property Tracker report from the Building Societies Association (BSA) shows a significant reduction in the number of homeowners concerned about paying their mortgage along with a decrease in those that see mortgage affordability as a barrier to home buying.

- Affordability of mortgage payments falls as a barrier to buying a home

- Fewer people are concerned about being able to pay their mortgage

- 41% think house prices will rise over the next 12 months

This is a welcome change, most likely reflecting the reduction in mortgage rates since last Autumn. Back then, Bank Rate had just risen to 5.25% and there was concern it could go higher. However, the next move in Bank Rate is now expected to be a cut, and this shift in expectations has been reflected in swap and mortgage rates. While some lenders have recently announced increases in mortgage rates as market expectations adapt, they remain below the levels of last year.

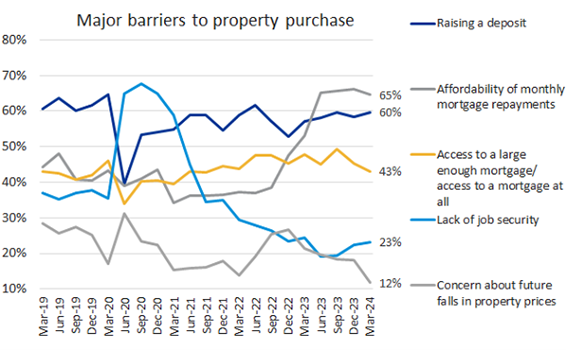

Whilst affording a mortgage remains the biggest barrier to buying a home, it has fallen significantly to 62% in March, from 71% six months ago in September 2023.

Affordability concerns reduce

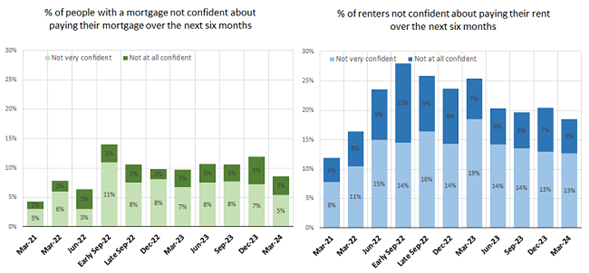

When homeowners were asked how confident they are about paying their mortgage over the next six months, 9% said that they are either not very confident or not at all confident. This is welcome reduction from 12% in December 2023, and the lowest level for almost two years. This is also despite recent data showing a slight increase in mortgage arrears in the final quarter of last year.

The majority of people asked did not express any concerns about keeping up with their mortgage payments, with 90% of mortgage borrowers confident they will keep up with payments, an increase from 85% in December 2023.

Those who rent their home are a little less assured with three-quarters (74%) confident about meeting their monthly payments. However, this is the highest confidence score since March 2022, with a corresponding reduction in those not confident, to 18% (from 20% in December).

Other Barriers to Home Buying

The report shows that concerns about future falls in property prices has decreased as a barrier to buying a residential property, from 18% to 12%. This is the lowest level it has been for eight years.

Raising a deposit remains a significant barrier to buying a home, 60% of people cited this as a reason, virtually unchanged since December.

House prices

41% of people think house prices will rise over the next 12 months, a significant increase from 33% in December 2023. This is the highest proportion expecting a price rise since June 2022. There was a corresponding big shift in those who think house prices will fall in the next year, with only 14% believing this to be the case, compared to 24% in December.

Market sentiment

Sentiment in the housing market remains weak but has improved since December 2023. The proportion of people who think now is a good time to buy a property is 19% compared to 16% in December. This is the highest it has been since December 2021.

36% of people disagreed, meaning they do not think now a good time to buy a new home, a considerable drop from December 2023 (41%).

Commenting on the findings, Paul Broadhead, Head of Mortgage and Housing Policy at the BSA said:

“The overall reduction in mortgage rates following the peak in 2023 has been welcomed by homebuyers, and has seen an improvement in confidence in the housing market.

“While consumer prices remain high, wage growth has been strong meaning many households are now in a stronger position than six months ago. There is also an expectation that if inflation continues to fall, the Bank Rate may be cut this year, further easing pressures on borrowers and increasing mortgage affordability.

“Whilst affordability of mortgage payments remains the biggest barrier to house purchase, it is reassuring that this has reduced over the past six months. Expectations around house prices reflect this more stable outlook for the housing market.

“Whilst there has been a welcome reduction in those that are concerned about meeting their mortgage payments, lenders remain very aware that there are a number of homeowners who are struggling. They are ready to help and well equipped to offer tailored support to anyone who may be struggling and would encourage anyone with concerns to contact them as soon as possible.”

Notes to Editors:

- The Building Societies Association (BSA) represents all 42 building societies, as well as 7 of the larger credit unions. Building societies serve around 26 million consumers across the UK and have total assets of over £507 billion. Together with their subsidiaries, they have helped over 3.5 million families and individuals to buy a home with mortgages totalling over £375 billion, representing 23% of total mortgage balances outstanding in the UK. They are also helping over 23 million people build their financial resilience, holding over £370 billion of retail savings, accounting for 19% of all cash savings in the UK. Within this, societies account for 40% of all cash ISA balances.

- With all of their headquarters outside London, building societies employ around 51,500 full and part-time staff. In addition to digital services they operate through approximately 1,300 branches, holding a 28% share of branches across the UK.

- For the March Property Tracker survey fieldwork was undertaken between 8th and 11th March 2023. Total sample size was 2,049 adults. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+). All figures, unless otherwise stated, are from YouGov Plc.

- When selecting barriers to property purchase respondents were asked to choose their top 3 barriers from a list of options.

- When calculating the proportion of those concerned about paying their mortgage or rent it excluded respondents who said ‘not applicable’ or ‘prefer not to say’.

- The proportion agreeing ‘now is a good time to buy’ includes those who agree strongly and those who tend to agree, while the proportion disagreeing includes those who disagree strongly and those who tend to disagree. Respondents who answered 'don't know' are not shown, so percentages do not sum to one hundred.

- Respondents were given the option to select up to three barriers’ when asked what they think are most likely to stop someone from buying a residential property at the moment.

- The Property Tracker data table can be here