"You either eat reasonably well or you freeze to death": Inside the UK energy crisis

Heating or eating? (Credit: Tracy Worrall)

10 min read

Energy bills have risen to a level that has forced 6.7 million households into fuel poverty. As bills seem set to remain high for the foreseeable future, Sophie Church explores how we reached this crisis point, and what government is doing to help

Illustrations: Tracy Worrall

“I see people in the supermarkets just standing there studying the shelves, and you know what they are all thinking: ‘can I afford one of those?’”

Sheila Carrell, in her late 70s, is calling from Lincolnshire, where she lives alone with her three cats and a dog in a house she is finding painfully costly to heat. At the time of speaking, she is going out on her afternoon walk, which usually warms her up for an hour or so. She then returns home, and waits for the cold to set in again.

Carrell is one of many people currently facing a recurring dilemma: heating or eating? “You either eat reasonably well or you freeze to death,” she says simply.

Energy crisis protesters (Credit: horst friedrichs / Alamy Stock Photo)

Energy crisis protesters (Credit: horst friedrichs / Alamy Stock Photo)

National Energy Action has calculated that 6.7 million households currently live in fuel poverty, meaning when homeowners spend the required amount to heat their home, the money circling the pot takes them below the poverty line. In 2022, Department for Energy Security and Net Zero statistics showed that 13.4 per cent of all households were living in fuel poverty.

Tessa Khan, executive director and founder of climate campaign group Uplift, says our dependency on gas has dragged us into this affordability crisis. “There is a lot of analysis, including from the International Monetary Fund and others, showing that households in the United Kingdom have got the highest energy bills in Western Europe,” she says, “and that is because of the extent to which we rely on gas for household heating, and also the proportion of gas in our electricity mix.”

Over the course of 2022, electricity prices in the UK rose by 66.7 per cent, and gas prices rose by 129.4 per cent according to the Office for National Statistics. Just under half of adults who pay energy bills said they found it difficult to afford them. “Our state pension is £184 a week,” says Carrell. “I haven’t had any central heating on all winter and my bill is still around £96 a month, and I am just living on the basics. The way prices have gone up is disgusting. That government doesn’t know what it’s like. They don’t care. They don’t know what it’s like to be in this position.”

Renewable energy sources (Illustration: Tracy Worrall)

Renewable energy sources (Illustration: Tracy Worrall)

However the government’s Energy Price Guarantee has thrown the public a lifebuoy – in capping energy bills at £2,500 a year since October 2022. While the support could expire from 1 April, leaving people paying £3,000 a year, it is thought that Chancellor Jeremy Hunt will announce an extension of the scheme for another three months in his Spring Budget.

Still, Khan says we are “in the worst position of countries in Europe, partly because our houses are so draughty and poorly insulated”. National Energy Action warned it will take 300 years for the government to meet its end-of-decade energy efficiency targets for homes at its current rate of progress.

Opening up huge new fields like Rosebank would be wildly irresponsible from the government, pouring fuel on the climate fire that is engulfing the world

The UK is not the only country struggling with rising energy prices. Research from the European Commission suggests that before Russia invaded Ukraine, it had provided the European Union with 40 per cent of its gas imports. However, after international sanctions were imposed, Moscow cut gas exports to the EU by 80 per cent. According to figures published in the journal Nature Energy, the cost of natural gas on the global market rose by 94 per cent between 24 February and 13 September 2022. Prices have also soared globally as Covid-19 restrictions have lifted and demand for gas has increased. Emerging markets like China, whose economies are still growing, are driving this demand, says Khan.

Crucially, international fluctuations in gas prices affect the price we pay for gas domestically. “Fossil fuels are inherently part of a global market,” Khan explains. “That means that we are really vulnerable to geopolitical events, like Russia’s invasion of Ukraine, or countries like China having a bounce in how much oil and gas they use.”

Rob Gross, director of the UK Energy Research Centre, thinks prices could remain high for the foreseeable future. “The supply constraint on gas into Europe caused by Ukraine is not very likely to have gone away by next winter or probably the winter after that,” he says. “I think most people expect us to be in a period of sustained high prices. Historically if the gas price went up by 30 per cent we would say that was a dramatic increase, but what we have seen in the last year and a half is 500 per cent increases. So, if it eases back down, it has still doubled its long-term, average price.”

Renewable energy sources (Illustration: Tracy Worrall)

Renewable energy sources (Illustration: Tracy Worrall)

Now is a perfect moment, Khan suggests, to move away from polluting, expensive and finite oil and gas reserves, and to transition towards cheaper, cleaner renewable energy sources. “We have learned in the last year that certainly, because of how high the gas price was, it was nine times cheaper to generate electricity from wind than it was from gas,” she says. “It is generally true now that renewable energy sources are a much cheaper way of generating electricity than fossil fuels.”

Khan says there is a race on to invest into green technology, and the UK is lagging behind. “The United States has just announced a £360bn package of investment and incentives for growing green energy and green technology through the Inflation Reduction Act; the EU is considering or is currently developing a similar package of measures – the rest of the world is moving clearly in that direction,” she says. “The United Kingdom is blessed with the best offshore wind resources in Europe; Ernst Young and others have said that it is a massive investment opportunity. But the government is just not pulling the levers and making the decisions that it needs to give the market certainty that it needs to really start growing here.”

In the immediate term, campaigners have called for the ban on onshore wind farms, in place since 2015, to be lifted. In research carried out by the Department for Business, Energy and Industrial Strategy in 2021, 80 per cent of the public were in support of onshore wind farms. However, only two wind turbines were erected in England in the past three years. While the government said in December that it would adapt the National Planning Policy Framework to permit onshore wind development where local consent is given, campaigners argue that too much paperwork is hindering wind farms from being built quickly.

Offshore wind farm (Phil Stock / Alamy Stock Photo)

Offshore wind farm (Phil Stock / Alamy Stock Photo)

“It takes up to 12 years to get a new offshore wind farm up and running. But actually building them only takes two maximum three years,” says Sam Richards, chief executive officer of infrastructurecampaign group Britain Remade. “There is a huge chunk of time in that process with developers going through the planning process: doing environmental impact assessments and getting consent for the project. We think it is possible to significantly reduce that timeline, meaning that we can get more clean power up and running sooner.”

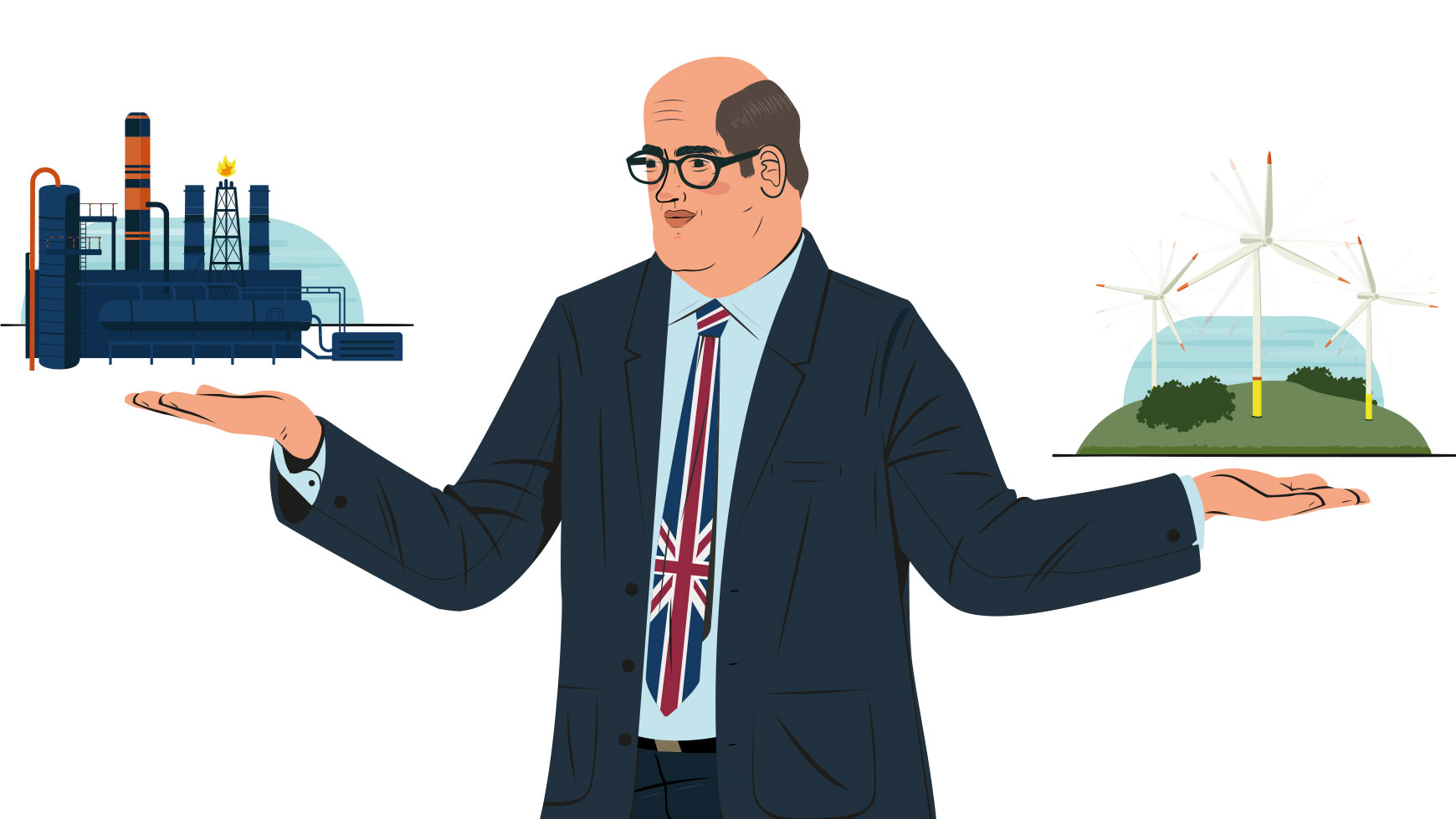

However, the renewable sector is not alone in arguing for development barriers to be removed. The oil and gas sector claims that drilling for fossil fuels domestically may ease our supply issues and help bring down energy prices. The government is attentive, with Energy Security and Net Zero Secretary Grant Shapps expected to decide whether to approve a new North Sea scheme – Rosebank – shortly ahead of plans to strike oil in 2026. According to research by Wood Mackenzie and Voar Energy, Rosebank is estimated to produce an average of 21 MMSCF of natural gas every day, equivalent to the daily average use of Aberdeen.

The way prices have gone up is disgusting. That government doesn’t know what it’s like. They don’t care

However, some 200 charities have written to Prime Minister Rishi Sunak to warn against the Rosebank scheme. “Opening up huge new fields like Rosebank would be wildly irresponsible from the government, pouring fuel on the climate fire that is engulfing the world,” says 24-year-old Friends of the Earth Scotland campaigner Freya Aitchison. “The last thing that we should be doing in the state is actively encouraging and subsidising more oil and gas production,” adds Khan. “I think the Rosebank oilfield is the best kind of symbol of how misconceived the government’s approach to energy is. It involves giving half a billion pounds to a hugely profitable Norwegian oil and gas company, it is going to create greenhouse gas emissions that are the equivalent of [what] the 28 lowest-income countries produce annually. And it is going to put a massive pipeline through a marine protected area. It just makes no sense.”

Rosebank protesters (Credit: Sipa US / Alamy Stock Photo)

Rosebank protesters (Credit: Sipa US / Alamy Stock Photo)

While the government has implemented a windfall tax on oil and gas companies – which United States President Joe Biden claims to have been “war profiteering” from Russia’s invasion of Ukraine – many have been making use of a loophole that reduces the amount of tax they have to pay.

This loophole means that if companies invest in more North Sea oil and gas development, they can claim up to 91 per cent of their investment in tax relief.

In February, Shell announced profits of $40bn – its highest profits in 115 years. However, it only paid $134m to the government in windfall tax.

Despite oil and gas companies receiving tax relief for investing into renewables, renewable energy companies have not, up until now, received the same financial incentives. While the Spring Budget now qualifies wind farms for a 50 per cent capital allowance, developers like Ørsted, who are working on the Hornsea Three offshore wind turbine project, were hoping for more targeted, long-term support.

Energy decision making (Illustration: Tracy Worrall)

Energy decision making (Illustration: Tracy Worrall)

Even with further investment into renewable energy, we will need to continue using oil and gas to detransition away from fossil fuels. “There is absolutely no contradiction between boosting [oil and gas] and achieving net zero,” says Charles McAllister, director of policy, government and public affairs at United Kingdom Onshore Oil and Gas, a body representing the onshore oil and gas industry. “There is going to be oil for very residual use for making things like toothpaste and tarmac, and gas is used to make blue hydrogen. So yes, oil and gas demand [will] decrease, I would never argue against that, the idea we are not going to need it is wrong.”

There are signs we are heading towards net zero quicker than other countries, despite our continued fossil fuel use – with Carbon Brief analysis showing that the UK’s emissions fell faster than the global or EU average and faster than Germany, the US, Canada, China or India in 2022.

In Carrell’s mind, how we harness our energy is of little importance. She just wants her bills to reduce so she can return to a normal way of life. “I don’t think people in the latter years of our lives should have to put up with poverty. Everyone is worrying all the time about prices of this, prices of that, keeping warm,” she pauses, before adding, “keeping just barely human.”