Driving homes for Christmas

Skipton Group Home Affordability Index

Stuart Haire, Group Chief Executive

| Skipton Group

Earlier this year, Skipton Group, one of the UK’s leading member-owned businesses, launched new research into home affordability in Great Britain today. In the light of its findings, Stuart Haire, Skipton Group’s Chief Executive, shares his new year resolution to help more people into a home.

During the festive season, our thoughts naturally turn to the home and its place at the heart of Christmas. But for seven in every eight potential first-time buyers, a home of one’s own remains unaffordable in their area, based on their own financial situation.

Click image to enlarge

Click image to enlarge

At Skipton Group, which includes Skipton Building Society, where we proudly serve over one million members, and the UK’s largest estate agency, Connells, we help people into homes every day. Through the 18,000 colleagues across our businesses we have a unique vantage point at the crossroads of homes and money. And we see and hear the challenge of home affordability every day.

At the heart of our business are two core commitments: helping people into homes and making their finances work harder. Today that means moving beyond the simple calculation of house prices, income, and rent – to a deeper understanding of what is really driving home affordability across the country.

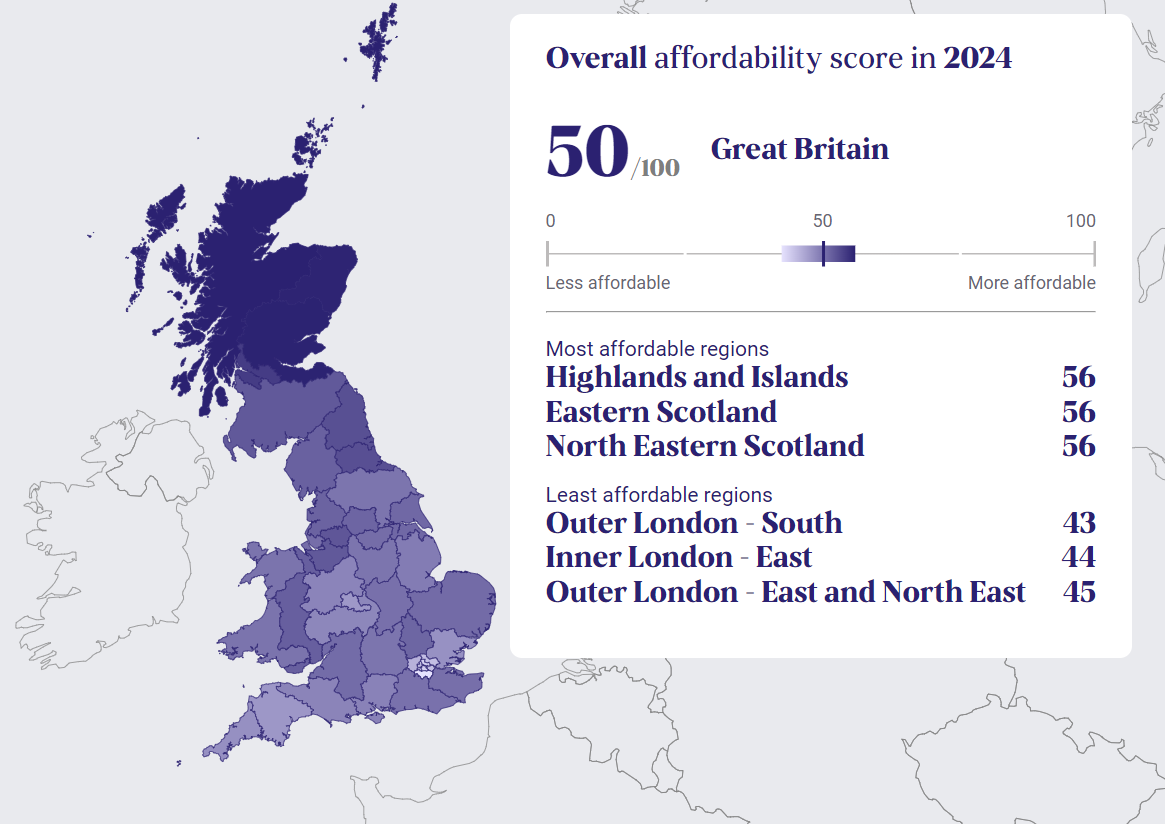

In that endeavour, this summer we launched the Skipton Group Home Affordability Index, a first-of-its-kind approach to analysing home affordability in Great Britain, that combines data on the affordability of purchasing a property with the affordability of running one into a single metric. This means it includes the very real factors of mortgage or rental costs as well as household bills, maintenance and even the typical household goods we all need to buy.

It shows the stark reality and scale of the challenge. Just one in eight potential first-time buyers can purchase the average first-time buyer house in their area, based on their own financial situation. That falls to fewer than one in a hundred for first-time buyer households earning £23,000 a year or less. And the issue is particularly pronounced in some areas – with the West Midlands, London and Wales identified as the least affordable areas for first-time buyers in Great Britain.

It also shows that low levels of home affordability persist even across higher income brackets. Only forty-four per cent of those earning over £71,000 a year can afford to buy their first home in their local area.

I encourage you to use our interactive online tool to engage with the findings yourself. Utilising data from across Skipton Group businesses and in partnership with Oxford Economics, it allows you to personalise the data, providing insights by region, income level, age, and household type.

The launch of our Index is just the beginning. Heading into 2025, we will update our findings twice per year to ensure data and insights are at the fingertips of policymakers working hard to improve home affordability for the future.

And our efforts don’t stop here. Skipton Building Society has provided hope to renters across the country who want to own their own homes by launching our groundbreaking Track Record mortgage. This helps renters with a track record of regular monthly rental payments but who, due to their high rents, have been unable to also save the significant sums needed for a house deposit.

I am immensely proud that we are on track, this year, to have helped more people into homes than ever before.

It is part of our long-term commitment to play our role in enabling more people to access safe, affordable housing. We don’t have all the solutions but see the greatest scope of solutions in collaboration. The challenge of home affordability is so great that a joined-up approach – across government, and between government and business – gives us the best potential for progress. And we stand ready to be part of those efforts.

Into 2025, we stand ready to collaborate with the entire housing ecosystem to help more people into a home of their own.

-

Only 1 in 8 potential first-time buyers in Great Britain can purchase the average first-time buyer property in their area, based on their own financial situation. This falls to just 1 in 100 for those earning £22,850/yr or less1.

- Almost 80 per cent of potential first-time buyers have insufficient savings for the deposit needed to get onto the property ladder in their area.

- Nearly 4 in 10 renters are spending 45 per cent or more of their income on essential housing costs, creating a major barrier to saving for a deposit.

- West Midlands, London and Wales, identified as the least affordable areas for first-time buyers in Great Britain.

1. The bottom quarter of earners based on the distribution of household income in the Wealth and Asset Survey and adjusted using average weekly earnings growth.