UK ad spend up 15.9% in Q3 2023 to £9.6bn

Higher-than-expected increase driven by search and online display & preliminary estimate for 2023 UK ad spend upgraded to £37bn, a rise of 6.4% year-on-year

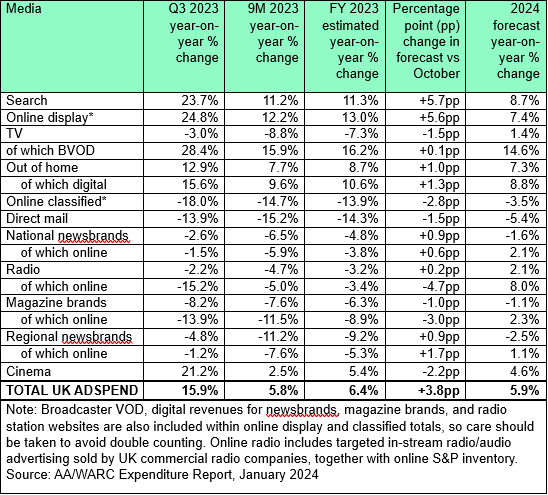

London, January 25, 2024: The latest quarterly data from the Advertising Association and WARC Expenditure Report shows UK advertising spend rose by 15.9% to a total of £9.6bn for the period July to September 2023. This marks the first time that advertising spend in Q3 has exceeded the £9bn mark, driven predominantly by a sharp increase in online advertising.

The UK advertising market is now thought to have grown by 6.4% in 2023, reaching a total of £37bn for the year, which represents a sizeable 3.8pp upgrade from the previous forecast (published in October 2023), with final figures for FY 2023 due to be published in late April 2024. The projection for advertising spend this year has been upwardly revised to £39bn, equating to a year-on-year increase of 5.9%. All of this is further evidence of increased confidence in advertising and marketing spend, echoing the recently released IPA Bellwether figures which showed UK marketing budgets for 2024 have seen the greatest upwards revisions in more than a decade.

A closer look at Q3 2023 results

Despite the wider economic market conditions, search (including retail media) and online display (including social media) advertising spend generated higher-than-expected figures in Q3 2023. Search marked its strongest performance in 18 months rising by 23.7% and online display followed suit with a 24.8% increase, also achieving its highest gain in the same period. For comparison, online growth in France was approximately 5% during the quarter, while the UK grew 4.6 times faster at 22.3%. Online retailers increased their online ad spend in the UK market by 156% during Q3 2023 as competition for household budgets increased.

Other channels also experienced growth in Q3 2023; cinema was up 21.2% and out-of-home 12.9%, while spend on broadcaster video on-demand (BVOD) increased by 28.4%, reflecting in part the role on-demand viewing played during the Women’s FIFA World Cup.

Looking ahead to 2024

This year will see a continued increase in advertising spend across more channels, with events such as the Men’s Euros this summer, the likelihood of a General Election and residual coverage of the Olympics contributing positively to this trend. TV advertising is set to return to positive figures – up 1.4% year-on-year – mostly driven by increases in BVOD (+14.6%). The latest AA/WARC dataset also expects a return to growth for radio (+2.1%), as well as the online channels of national newsbrands (+2.1%), regional newsbrands (+1.1%) and magazine media (+2.3%).

Stephen Woodford, CEO, Advertising Association, said: “The Q3 increase in 2023 and 2024 forecast upgrade demonstrate advertisers’ continued commitment to investing in their brands, despite the lack of overall growth and stubborn inflationary pressures in the UK economy. The IPA’s latest Bellwether forecast upgrade is further evidence of this, with the strongest improvement in advertiser expectations on total marketing budgets since 2014. Our forecasts indicate the advertising industry is performing better than the wider UK economy, with spend expected to reach £39bn in 2024. All this should provide confidence that the industry is well positioned to help the UK’s economy tackle the economic and social challenges it faces, by promoting product and service innovation, stimulating competition and supporting jobs.”

James McDonald, Director of Data, Intelligence & Forecasting, WARC, said: “With the UK’s economy in the doldrums, the online ad sector’s strongest performance in over 18 months – growing five times faster than in key European markets – came as a welcome respite for an ad industry worth a record £37bn overall last year. Data show that online retailers more than doubled their online advertising spend during the third quarter, as pricing became competitive and brand salience paramount when attracting stretched household budgets. Our expectations for 2024 are now brighter on the tailwind of a strong end to last year and positive sentiment across the marketing and wider business sectors.”

The Advertising Association/WARC quarterly Expenditure Report is the definitive guide to advertising expenditure in the UK with data and forecasts for different media going back to 1982.

For more information, please contact:

Advertising Association

Matt Bourn, Director of Communications

Matt.Bourn@adassoc.org.uk

Mariella Brown, Communications Manager

Mariella.Brown@adassoc.org.uk

WARC

Amanda Benfell, Head of PR & Press

amanda.benfell@warc.com

T: +44 (0) 20 7467 8125

About the Advertising Association/WARC Expenditure Report

The Advertising Association/WARC quarterly Expenditure Report is the definitive guide to advertising expenditure in the UK. Impartial and independent of any media channel or agency affiliation, it is the only source of historical quarterly adspend data and forecasts for the different media for the coming eight quarters. With data from 1982, this comprehensive and detailed review of advertising spend includes the AA/WARC’s own quarterly survey of all national newspapers, regional newspaper data collated in conjunction with Local Media Works and magazine statistics from WARC’s own panels. Data for other media channels are compiled in conjunction with UK industry trade bodies and organisations, notably the Internet Advertising Bureau, Outsmart, Radiocentre and the Royal Mail.

All data are net of discounts and include agency commission, but exclude production costs. The survey was launched in 1981 and has produced data on a quarterly basis ever since.

Methodology for WARC’s quarterly forecasts

Analysis of annual adspend data over the past 35 years shows that there is a link between annual changes in GDP and annual changes in adspend (after allowing for inflation, and excluding recruitment adspend). Over this period, GDP changes account for about two thirds of the change in adspend. WARC has developed its own forecasting model to generate forecasts for two years based on assumptions about future economic growth. The model provides an indication of likely overall spend levels – adjusted to allow for short-term factors (Olympics, World Cup etc).

The Expenditure Report (www.warc.com/expenditurereport) launched online in February 2010 and combines data from the discontinued print publications the Quarterly Survey of Advertising Expenditure and the Advertising Forecast. It is relied upon daily by the world’s

largest brands, ad agencies, media owners, investment banks and academic institutions. Alongside over 200 readymade tables, subscribers can create their own customised tables for analysis of different media and time periods, as well as track the different media’s share of adspend. All reports can be exported from the online interface. An annual subscription is priced at £760 for AA members and £1,175 for nonmembers.

About the Advertising Association

The Advertising Association promotes the role and rights of responsible advertising - trusted, inclusive, and sustainable – and its value to people, society, businesses,

and the economy. Responsible businesses understand that there is little point in an advertisement that people cannot trust. That's why, over 50 years ago, the Advertising Association led UK advertising towards a system of independent self-regulation which has since been adopted around the world. There are nearly thirty UK trade associations representing advertising, media, and marketing. Through the Advertising Association they come together with a single voice when speaking to policy makers and influencers.

About WARC – The global authority on marketing effectiveness

For over 35 years, WARC has been powering the marketing segment by providing rigorous and unbiased evidence, expertise and guidance to make marketers more effective. Across four pillars - WARC Strategy, WARC Creative, WARC Media, WARC Digital Commerce - its services include 100,000+ case studies, best practice guides, research papers, special reports, advertising trend data, news & opinion articles, as well as awards, events and advisory services. WARC operates out of London, New York, Singapore and Shanghai, servicing a community of over 75,000 marketers in more than 1,300 companies across 100+ markets and collaborates with 50+ industry partners.

WARC is an Ascential company. Ascential delivers specialist information, analytics, events and eCommerce optimisation to the world's leading consumer brands and their ecosystems. Its world-class businesses improve performance and solve customer problems by delivering immediately actionable information and visionary longer-term thinking across Digital Commerce, Product Design, Marketing and Retail & Financial Services.

With more than 3,800 employees across five continents, Ascential combines local expertise with a global footprint for clients in over 120 countries. Ascential is listed on the London Stock Exchange.