UK advertising spend reached £9.2bn in Q1 2024

£9.7bn forecast for Q2 following Men’s Euros and snap General Election, with FY 2024 forecast up 7.7% to £39.4bn

London, July 25, 2024: The latest Advertising Association/WARC Expenditure Report shows UK ad spend increased 9.3% to £9.2bn during the first three months of 2024 – setting a new high for a first quarter period. Data reveals this rise was almost three percentage points (pp) ahead of forecast, due to stronger-than-expected online growth, with online formats accounting for 79.7% of all UK spend in Q1 2024.

The new AA/WARC forecasts expect UK ad spend to rise 9.2% in Q2 (April to July) this year to reach £9.7bn, a result of increased spending around the Men’s Euros and snap General Election. This would equate to a rise of 9.3% during the first half of 2024, to a total of £18.9bn.

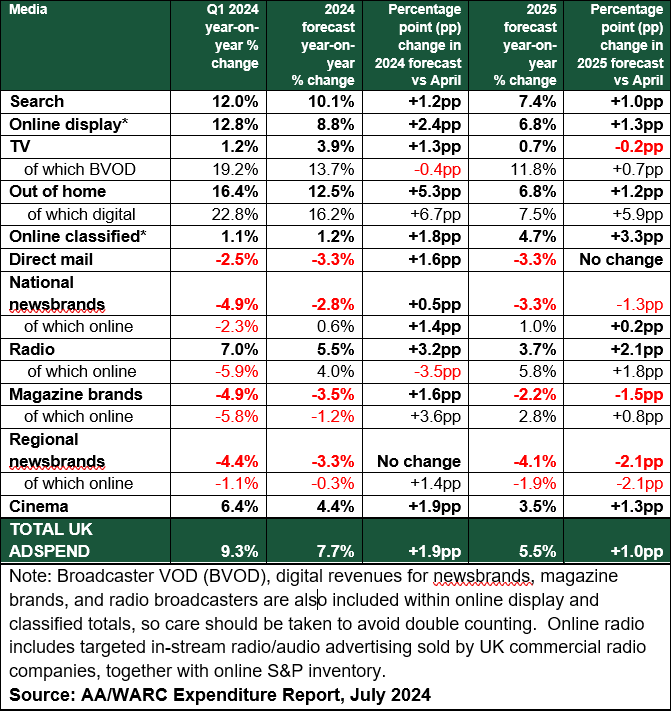

Expectations for both 2024 and 2025 have seen an uplift in the latest dataset. The UK advertising market is now expected to grow by 7.7% to reach £39.4bn this year, an upgrade of 1.9 percentage points (pp) since AA/WARC’s April forecast, owing to strong digital results and increased investment around Euro 2024. Overall, this year, channels expected to see a boost include Out of Home (+12.5%), Search (+10.1%) and Radio (+5.5%). Advertising spend on the Broadcaster Video On-Demand (BVOD) portion of TV is set to cross the £1bn threshold for the first time (an increase of 13.7%), driven by a strong summer of sport including demand from the Men’s Euros, and to a slightly lesser extent, the upcoming Olympics and Paralympics.

A further rise of 5.5% is expected in 2025, by when the UK’s advertising market is set to reach £41.6bn, an upgrade of 1.0pp from the April forecast.

The full picture in Q1 2024

The online advertising market had a strong quarter from January to March, with search (including retail media) up by 12.0% and online display (including social media) up 12.8%. The latest dataset shows a return to growth for cinema (+6.4%) and TV (+1.2%), with BVOD seeing a continued strong increase at 19.2%.

After allowing for inflation, real growth for adspend in Q1 stood at 5.5%1, indicating the UK advertising market saw a healthy £465m of organic growth, as inflationary pressures eased year-on-year.

If we look at results at the topline category level, the data shows that products within the Consumables sector saw 16.1% growth in Q1 (including food & drink, cosmetics and household FMCG), with Services (including leisure & entertainment, media and transport) registering a rise of 8.9%. All other major categories posted year-on-year declines for the period, however.

Stephen Woodford, Chief Executive, Advertising Association said: “It is welcome news to see real-term growth and upgraded forecasts in the advertising market in Q1 this year, a positive sign that our industry is one of the driving factors in the UK’s economic recovery. This is a timely reminder of its dynamism as the new Government seeks to create an environment for growth, through political stability and a new industrial strategy. Advertising is a UK-wide industry, with three in five advertising jobs based outside of London and it is central to the successful development of the digital economy across the whole country.”

James McDonald, Director of Data, Intelligence & Forecasting, WARC said: “The race for AI adoption has intensified in the advertising industry, with major online platforms introducing their own solutions to market and subsequently reporting a positive contribution to their bottom line. The true impact of these tools will emerge in time, though first quarter results were certainly lifted by higher ad loads and associated performance costs online.

“That said, the enduring strength of legacy display media – chiefly TV, out of home, radio and cinema – was also evident in the first quarter, and we expect this to have sustained into the second due in part to short term stimuli such as the Men’s Euros and snap General Election. Overall, our outlook for the coming year is brighter than our last projection in April, with a forecast 7.7% rise in total ad spend this year ahead of the average rate recorded before the pandemic.”

The quarterly Advertising Association/WARC Expenditure Report is the definitive guide to advertising expenditure in the UK, with data for all key advertising media and sub formats dating back to 1982 and forecasts spanning eight quarters ahead.

1. Indexed to 2015

For more information, please contact:

Advertising Association

Matt Bourn, Director of Communications

Matt.Bourn@adassoc.org.uk

Mariella Brown, Senior Communications Manager

Mariella.Brown@adassoc.org.uk

WARC

Amanda Benfell, Head of PR & Press

amanda.benfell@warc.com

T: +44 (0) 20 7467 8125

About the Advertising Association/WARC Expenditure Report

The Advertising Association/WARC quarterly Expenditure Report is the definitive guide to advertising expenditure in the UK. Impartial and independent of any media channel or agency affiliation, it is the only source of historical quarterly adspend data and forecasts for the different media for the coming eight quarters. With data from 1982, this comprehensive and detailed review of advertising spend includes the AA/WARC’s own quarterly survey of all national newspapers, regional newspaper data collated in conjunction with Local Media Works and magazine statistics from WARC’s own panels. Data for other media channels are compiled in conjunction with UK industry trade bodies and organisations, notably the Internet Advertising Bureau, Outsmart, Radiocentre and the Royal Mail.

All data are net of discounts and include agency commission, but exclude production costs. The survey was launched in 1981 and has produced data on a quarterly basis ever since.

Methodology for WARC’s quarterly forecasts

Analysis of annual ad spend data over the past 35 years shows that there is a link between annual changes in GDP and annual changes in ad spend (after allowing for inflation, and excluding recruitment ad spend). Over this period, GDP changes account for about two thirds of the change in ad spend. WARC has developed its own forecasting model to generate forecasts for two years based on assumptions about future economic growth. The model provides an indication of likely overall spend levels – adjusted to allow for short-term factors (Olympics, World Cup etc).

The Expenditure Report (www.warc.com/expenditurereport) launched online in February 2010 and combines data from the discontinued print publications the Quarterly Survey of Advertising Expenditure and the Advertising Forecast. It is relied upon daily by the world’s largest brands, ad agencies, media owners, investment banks and academic institutions. Alongside over 200 readymade tables, subscribers can create their own customised tables for analysis of different media and time periods, as well as track the different media’s share of ad spend. All reports can be exported from the online interface. An annual subscription is priced at £760 for AA members and £1,175 for nonmembers.

About the Advertising Association

The Advertising Association promotes the role and rights of responsible advertising - trusted, inclusive, and sustainable – and its value to people, society, businesses,

and the economy. Responsible businesses understand that there is little point in an advertisement that people cannot trust. That's why, over 50 years ago, the Advertising Association led UK advertising towards a system of independent self-regulation which has since been adopted around the world. There are nearly thirty UK trade associations representing advertising, media, and marketing. Through the Advertising Association they come together with a single voice when speaking to policy makers and influencers.

About WARC – The global authority on marketing effectiveness

For over 35 years WARC has been powering the marketing segment by providing rigorous and unbiased evidence, expertise and guidance to make marketers more effective. Across four platforms - WARC Strategy, WARC Creative, WARC Media, WARC Digital Commerce – its services include 100,000+ case studies, best practice guides, research papers, special reports, advertising trend data, news & opinion articles, as well as awards, events and advisory services. WARC operates out of London, New York, Singapore and Shanghai, servicing a community of over 75,000 marketers in more than 1,300 companies across 100+ markets and collaborates with 50+ industry partners.

WARC is part of Ascential plc.